In this guide, we’ll dive deep into the best crypto trading bots of 2025.

We’ll explore their features, benefits, and how they can enhance your trading experience.

The world of crypto trading is ever-evolving, and staying ahead requires leveraging the best tools available.

In 2025, crypto trading bots will become indispensable for traders looking to optimize their strategies and maximize their profits.

But with so many options on the market, which ones truly stand out?

Let’s dive right in.

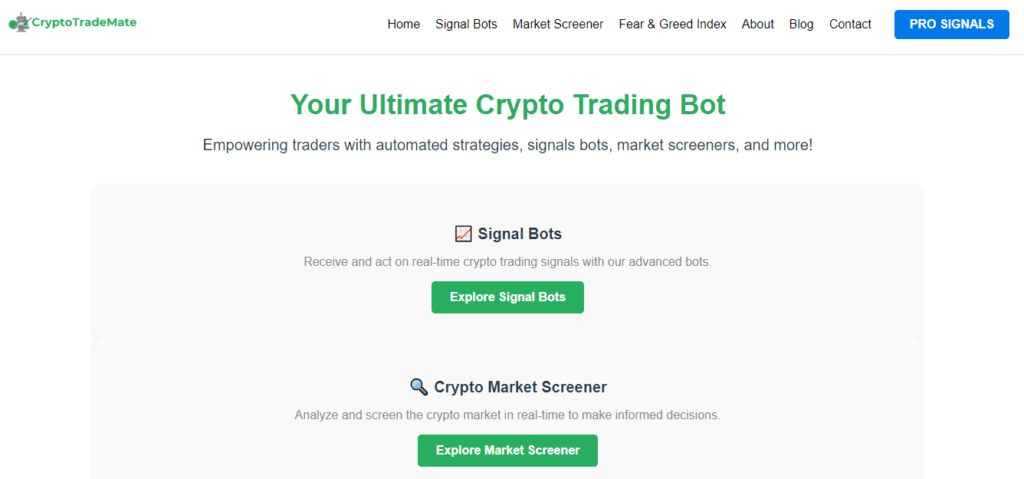

1. CryptoTradeMate

First on our list of the best crypto trading bots is CryptoTradeMate. This bot has quickly gained a reputation for its robust functionality and user-friendly interface.

Whether you’re a novice trader or a seasoned pro, CryptoTradeMate offers a suite of features designed to boost your trading efficiency.

And here’s the best part: It’s open-source. Developers, traders, and startups can customize it, improve it, or even build their tools on top of it.

In 2025, CryptoTradeMate is leading the way as one of the Top AI blockchain companies, making automated crypto trading more accessible and efficient for everyone.

Key Features and Benefits:

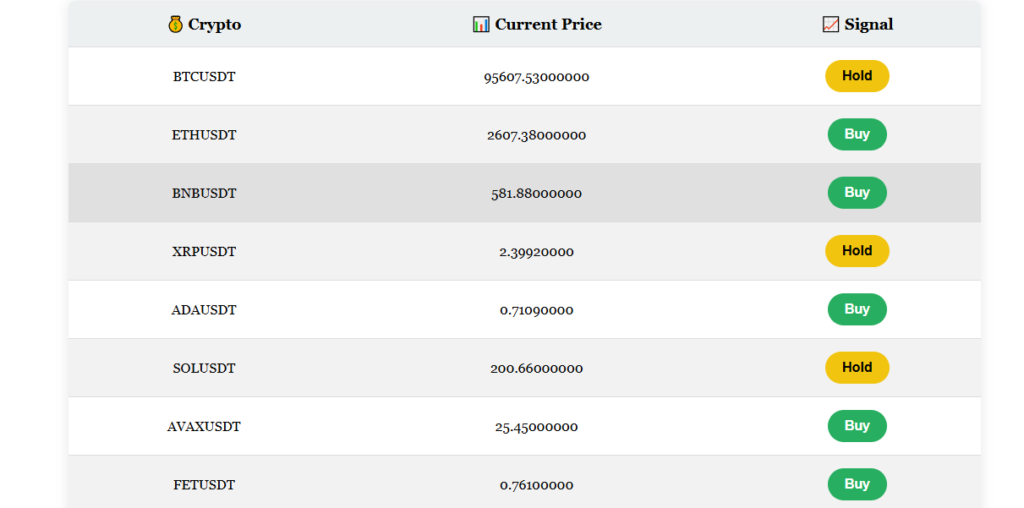

AI-Powered Signal Bots:

Get real-time trading signals designed to optimize your profits. Our AI-driven bots analyze market trends and provide precise buy, sell stop-loss, and take-profit zones.

Whether you’re a day trader or a long-term investor, our crypto signals bot adapt to your strategy for maximum returns.

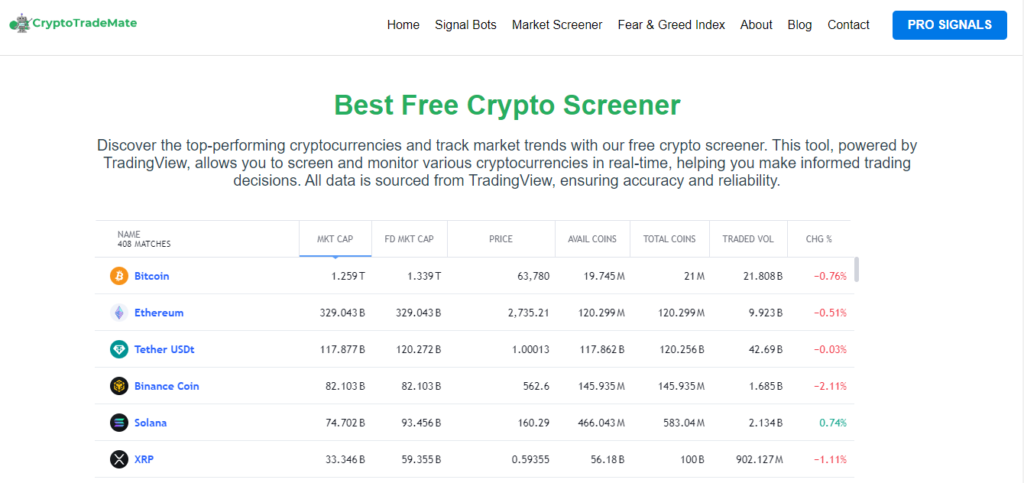

Market Screeners:

Stay ahead of the curve with our comprehensive market screening tools.

Our best free crypto market screener analyzes the top 400+ cryptocurrencies based on key metrics, allowing you to quickly identify promising coins to trade.

With CryptoTradeMate’s market screener, you’ll always know which assets are performing best and where the opportunities lie.

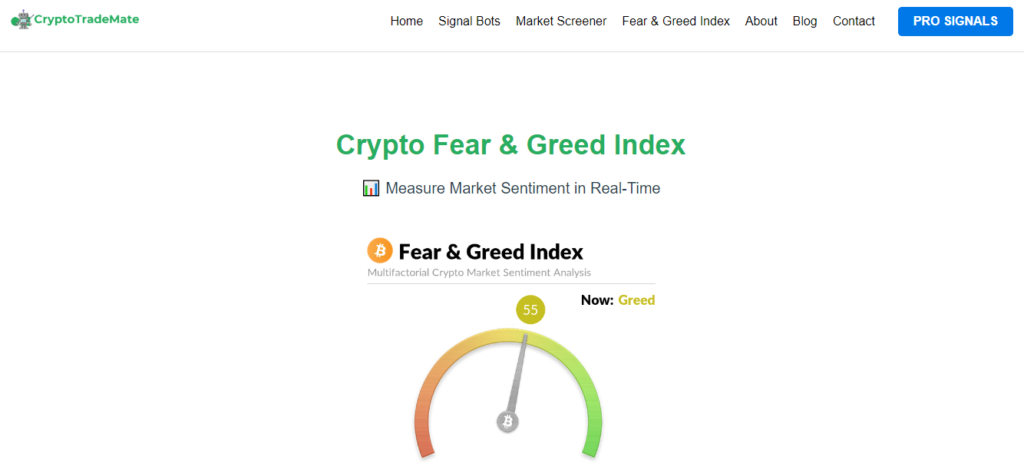

Fear and Greed Index Integration:

Understanding market sentiment is crucial for timing your trades. Our platform includes a visual representation of the Fear and Greed Index, providing you with a clear snapshot of market emotions.

This feature helps you make informed decisions—buy during fear and sell during greed—ultimately leading to smarter, more profitable trades.

Multi-Market Coverage (Spot & Futures):

Whether you’re trading spot or futures, CryptoTradeMate’s algorithms deliver tailored strategies for both markets.

Diversify your approach and minimize risk while maximizing profitability across multiple trading environments.

Comprehensive Market Analytics:

Beyond just signals, our platform offers in-depth market analysis tools that give you a holistic view of the market.

Use our advanced analytics to make data-driven decisions, plan your strategies, and optimize your portfolio for long-term success.

CryptoTradeMate’s real-time signals and automated trading capabilities make it a top choice for anyone serious about crypto trading.

Looking for a solid cryptocurrency to invest in? Check out CryptoTradeMate Token ($CTM8). It’s gaining attention for its strong potential and promising features.

$CTM8 is a great pick for anyone looking to get into the world of automated trading. It’s available to buy now on Pump, making it easy to get started.

$CTM8 could be a standout in 2025. If you’re serious about crypto, keep an eye on this token!

2. 3Commas

Next up is 3Commas, a well-known name in the trading bot industry.

What sets 3Commas apart is its versatility and powerful automation features.

Key Features:

Smart Trading Terminal: Manage multiple exchange accounts from a single interface.

Automated Bots: Utilize pre-configured or custom bots to automate your trades.

Portfolio Management: Track and manage your crypto portfolio with ease.

Copy Trading: Follow and replicate the strategies of successful traders.

With 3Commas, you can create complex trading strategies without any coding knowledge, making it accessible to traders at all levels.

3. CryptoHopper

CryptoHopper is another excellent option, known for its user-friendly setup and powerful trading features.

Key Features:

Strategy Designer: Create your trading strategies using over 130 indicators.

Backtesting: Test your strategies against historical data before going live.

Market-Making Bot: Provide liquidity and profit from market spreads.

Social Trading: Learn and copy the trades of expert traders.

CryptoHopper’s flexibility and extensive range of features make it a favorite among traders looking to customize their approach.

4. TradeSanta

TradeSanta is a great choice for those who prefer simplicity, It offers an easy-to-use interface without compromising on powerful trading tools.

Key Features:

Pre-Set Trading Strategies: Choose from a variety of strategies tailored to different market conditions.

Grid and DCA Bots: Automate your trading with tried-and-tested methods.

Telegram Integration: Monitor and manage your trades directly from Telegram.

24/7 Trading: Keep your trading active around the clock without manual intervention.

TradeSanta is ideal for traders who want to set up their bots quickly and start trading without a steep learning curve.

5. Zignaly

Zignaly trading platform combines simplicity with advanced trading capabilities.

Key Features:

Profit-Sharing: Invest with expert traders and share in their profits.

Signal Providers: Connect with top signal providers for real-time trade alerts.

Unlimited Trading: No limits on the number of trades or pairs you can manage.

Low Fees: Benefit from competitive pricing with no hidden costs.

Zignaly’s profit-sharing model is particularly attractive for traders who prefer to rely on expert guidance while still maintaining control over their accounts.

6. Bitsgap

Bitsgap is renowned for its comprehensive trading platform, which integrates multiple exchanges and offers sophisticated trading tools.

Key Features:

Arbitrage Trading: Capitalize on price differences across various exchanges.

Smart Trading Terminal: Manage your trades across multiple exchanges from one interface.

Grid Bots: Automate your trading with grid strategies.

Demo Mode: Practice your strategies risk-free.

Bitsgap is perfect for traders looking to exploit arbitrage opportunities and manage trades across different exchanges seamlessly.

7. Shrimpy

Shrimpy focuses on portfolio management and social trading, making it ideal for those who want to invest with a long-term perspective.

Key Features:

Social Trading: Follow and copy expert traders.

Automated Portfolio Rebalancing: Keep your portfolio aligned with your investment strategy.

Performance Tracking: Analyze the performance of your investments.

Backtesting: Test your portfolio strategies against historical data.

Shrimpy’s emphasis on portfolio management and social trading provides a balanced approach for both novice and experienced traders.

8. Quadency

Quadency combines automated trading and portfolio management in a sleek, user-friendly interface.

Key Features:

Unified Trading Dashboard: Manage all your crypto assets in one place.

Pre-built Bots: Choose from a variety of pre-configured trading bots.

Strategy Marketplace: Access strategies developed by other traders.

Advanced Charting Tools: Analyze market trends with powerful charting tools.

Quadency’s polished interface and comprehensive features make it an attractive option for traders seeking a seamless trading experience.

9. Kryll

Kryll stands out with its visual strategy editor, making it easy to create and deploy trading strategies.

Key Features:

Drag-and-Drop Strategy Builder: Create strategies without coding.

MarketPlace: Buy and sell strategies developed by other users.

Backtesting and Live Trading: Test and deploy your strategies in real time.

Social Trading: Share and follow strategies within the community.

Kryll’s intuitive visual editor and marketplace provide a user-friendly platform for traders looking to design and monetize their trading strategies.

10. Coinrule

Coinrule is designed for those who want to automate their trading without needing programming skills.

Key Features:

Rule-Based Trading: Create automated strategies using a simple “If-This-Then-That” logic.

Strategy Templates: Start with pre-made templates and customize them.

Educational Resources: Learn from tutorials and guides.

Free Plan Available: Get started without any cost.

Coinrule’s rule-based approach and educational resources make it an excellent entry point for traders new to automated trading.

11. Mudrex

Mudrex allows traders to create, test, and deploy strategies without writing any code.

Key Features:

Visual Strategy Builder: Design strategies with a drag-and-drop interface.

MarketPlace: Access and share strategies within the community.

Backtesting: Validate your strategies with historical data.

Community Support: Engage with a supportive community of traders.

Mudrex’s visual builder and marketplace make it a practical choice for traders seeking to automate their strategies with ease.

12. Pionex

Pionex offers a suite of trading bots designed to automate cryptocurrency trading strategies.

Here are some of its key features:

Key Features

- Grid Trading Bot: Automatically executes buy and sell orders within a specified price range, taking advantage of price fluctuations.

- Arbitrage Bot: Simultaneously buys and sells cryptocurrencies on different exchanges to profit from price discrepancies.

- Martingale Bot: Increases investment after losses to recover initial investment with a smaller subsequent profit.

- DCA Bot (Dollar-Cost Averaging): Invests a fixed amount of money in a cryptocurrency at regular intervals, regardless of price.

- Leverage Bot: Amplifies potential profits (and losses) by using borrowed funds.

Unique Features

- Trigger Price: Allows users to set a specific price at which the bot starts operating.

- Stop Loss Price: Automatically closes the bot if the price drops below a predefined level.

- Close Bot At: Enables users to set a specific price or time to automatically close the bot.

- AI Backtesting: Provides a simulated trading environment to test bot strategies.

- Grid Spacing: Offers both arithmetic and geometric options for grid trading.

- Release Profit: Allows users to set a profit target to close a portion of the bot’s positions.

- Orders Displayed on Chart: Visualizes open and closed orders directly on the price chart.

Pionex continues to innovate and introduce new features. It’s recommended to check their official website or documentation for the most up-to-date information.

13. Cryptotrader

Cryptotrader offers a cloud-based platform for developing and executing trading bots.

Key Features:

Strategy Marketplace: Access a variety of trading strategies.

Algorithmic Trading: Develop custom algorithms.

Backtesting: Validate strategies with historical data.

Cloud-Based: Run your bots without managing hardware.

Cryptotrader’s cloud-based approach and strategy marketplace provide flexibility for automated trading.

14. Hummingbot

Hummingbot specializes in market making and arbitrage trading.

Key Features:

Market Making: Provide liquidity and profit from bid-ask spreads.

Arbitrage Trading: Capitalize on price differences across exchanges.

Open Source: Customize and enhance the bot as needed.

Strategy Library: Access a variety of pre-built strategies.

Hummingbot’s focus on market making and arbitrage provides unique profit opportunities.

15. Tuned

Tuned is a platform for developing, testing, and deploying trading strategies.

Key Features:

Strategy Builder: Create custom strategies with an intuitive interface.

Backtesting: Validate strategies using historical data.

Live Trading: Deploy strategies on live markets.

Community Sharing: Share and access strategies within the community.

Tuned’s crypto trading bot strategy builder and community features make it a great platform for collaborative trading.

16. Bybit

Bybit is your trusted automation tool & trading bots for crypto trading 24/7.

Customize trades with Bybit Grid & DCA trading bot for maximum gains.

Key Features

- Automated Trading: Execute trades 24/7 without constantly monitoring the market.

- Multiple Trading Strategies: Choose from pre-configured bots like Grid Bot, DCA Bot, and Martingale Bot to fit your strategy.

- AI-powered Recommendations: Leverage AI for suggested strategies or set your parameters.

- Risk Management Tools: Define stop-loss and take-profit levels to manage risk.

- User-friendly Interface: Easy to set up and use for beginners and experienced traders.

- Multiple Market Support: Trade various crypto pairs in the Spot and Perpetual markets.

17. Binance

Binance is the largest cryptocurrency exchange by trading volume, serving 185M+ users across 180+ countries. With over 350 listed Altcoins.

Key Features

- Automated Trading Strategies: Execute trades 24/7 based on your chosen strategy (e.g., Grid Trading, DCA) without needing to manually monitor markets.

- Reduced Emotional Trading: Remove emotions from decision-making by letting pre-set rules guide your trades.

- Multiple Use Cases: Choose from various bots suited for different market conditions (volatile, sideways) and goals (profit taking, cost averaging).

- Simple Setup: Easily configure your bot with user-friendly interfaces and avoid complex coding.

Remember: Trading bots are tools, and success depends on your strategy and market conditions. Do your research before using any bot.

Conclusion

Choosing the right crypto trading bots can make a significant difference in your trading success.

In 2025, crypto trading bots like CryptoTradeMate, 3Commas, CryptoHopper, TradeSanta, and Zignaly are leading the pack with their innovative features and user-friendly designs.

By leveraging these tools, you can enhance your trading strategies, manage your portfolio more efficiently, and ultimately achieve better returns.

So, take the next step in your trading journey.

Explore these top-performing crypto trading bots and find the one that best suits your needs.

Happy trading!