Overview

The CryptoTradeMate AI Signal Bot uses a combination of technical indicators and trading strategies to generate buy, sell, and hold signals for spot trading.

This documentation provides an in-depth look at the indicators used and the strategies employed to ensure informed trading decisions.

CryptoTradeMate Trading Indicators

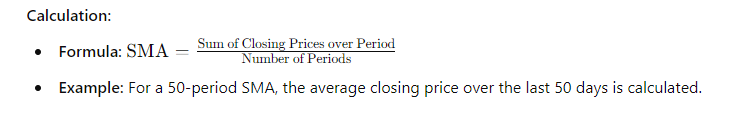

1. Simple Moving Average (SMA)

The Simple Moving Average (SMA) is a commonly used indicator that calculates the average price over a specified period. It helps smooth out price data and identify trends.

Calculation:

Usage:

- Trend Identification: Helps determine the overall direction of the market.

- Support and Resistance Levels: Can act as dynamic support and resistance levels.

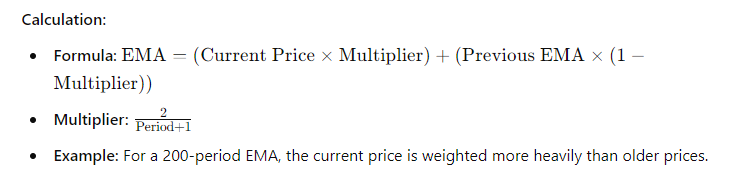

2. Exponential Moving Average (EMA)

The Exponential Moving Average (EMA) gives more weight to recent prices, making it more responsive to recent price changes compared to the SMA.

Calculation:

Usage:

- Trend Confirmation: Helps confirm the strength of a trend.

- Crossovers: Used in conjunction with shorter EMAs to identify potential buy/sell signals.

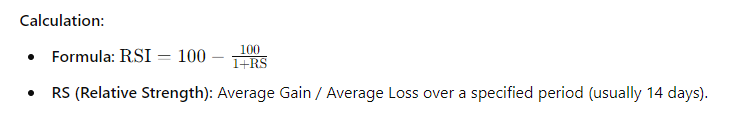

3. Relative Strength Index (RSI)

The Relative Strength Index (RSI) measures the speed and change of price movements. It oscillates between 0 and 100 and helps identify overbought or oversold conditions.

Calculation:

Usage:

- Overbought/Oversold Conditions: RSI above 70 suggests overbought conditions, while RSI below 30 indicates oversold conditions.

- Divergence: Used to spot potential reversals when the price makes a new high/low but RSI does not.

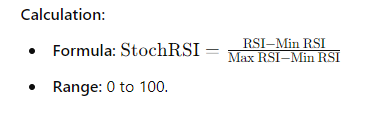

4. Stochastic RSI

The Stochastic RSI (StochRSI) is a momentum indicator that combines the RSI with stochastic oscillators. It is useful for identifying overbought and oversold conditions in the RSI.

Calculation:

Usage:

- Overbought/Oversold Conditions: Similar to RSI but more sensitive.

- Divergence: Helps in identifying potential reversals or trend changes.

CryptoTradeMate Trading Strategies

1. SMA and EMA Crossovers

This strategy uses crossovers between SMA and EMA to generate trading signals.

Signals:

- Buy Signal: When a shorter-term EMA crosses above a longer-term SMA, it indicates a potential uptrend.

- Sell Signal: When a shorter-term EMA crosses below a longer-term SMA, it indicates a potential downtrend.

Example:

A 50-period SMA and a 20-period EMA are used. A buy signal is generated when the 20 EMA crosses above the 50 SMA.

2. RSI-Based Trading

This strategy utilizes the RSI to identify overbought or oversold conditions and potential trading opportunities.

Signals:

- Buy Signal: When RSI drops below 30 (oversold) and then rises above it.

- Sell Signal: When RSI rises above 70 (overbought) and then falls below it.

Example:

If RSI is below 30 and starts to rise, a buy signal is generated. If RSI is above 70 and starts to fall, a sell signal is generated.

3. Stochastic RSI Divergence

This strategy looks for divergence between the Stochastic RSI and the price to spot potential reversals.

Signals:

- Buy Signal: When the price makes a lower low but the Stochastic RSI makes a higher low.

- Sell Signal: When the price makes a higher high but the Stochastic RSI makes a lower high.

Example:

If the price is making new lows while the Stochastic RSI is making higher lows, it indicates a potential buy opportunity.

Conclusion

The CryptoTradeMate Signal Bot leverages these indicators and strategies to provide actionable trading signals for spot trading. By combining SMA, EMA, RSI, and Stochastic RSI, the bot aims to deliver accurate and timely trading signals that help traders make informed decisions.

Get started now and unlock your full trading potential.

About Ihulabs:

Ihulabs is a leading blockchain and AI development company dedicated to delivering cutting-edge solutions for businesses and individuals in the digital economy. With a focus on innovation and user-centric design, Ihulabs continues to pioneer transformative technologies that empower our clients worldwide.